The Fed has raised interest rates again, and the news is full of gloom and doom. However, this is precisely the situation that educated investors prepare for: not panicking and selling their investments to pocket the cash. With inflation still over 8 percent, taking money out of the stock market and putting it in savings accounts will only reduce your wealth. And there's evidence that the sky isn't falling: the currently-rising mortgage interest rates are still below the long-run average, and mortgage applications actually increased slightly last week. And while homebuilders are definitely feeling the pinch, home prices have yet to fall very much.

Check Long-Run Trends

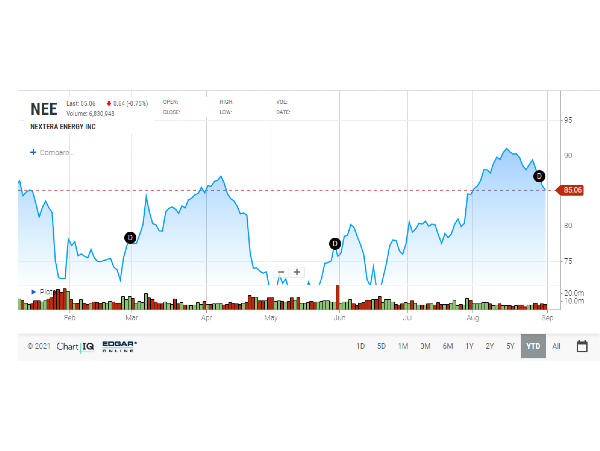

Things seem bad, but they're not that bad. The U.S. suffered through high inflation during the late 1970s and early 1980s, but investors still made money. It wasn't great, but it did create real (adjusted for inflation) profit. While many stocks struggled, those representing commodities (goods) tended to do fine. With recessionary fears on the rise, it may be time to shift investments toward stocks that represent goods with relatively constant demand, such as agriculture, oil, and essential consumer items. But the Fed managed to get inflation under control by the early 1980s, so it has a roadmap - although it may be painful - to navigate the current crisis.

Government is Actively on the Case

The days of laissez-faire economics is definitely over. Although the Fed admits that its inflation-fighting interest rate hikes may indeed cause a recession, the federal government is ready to act. And, like it or not, even conservative Republicans have shown themselves willing to engage in some fiscal stimulus to court voters. If worse does come to worst and the United States ends up embroiled in a true recession, both parties will likely unite around some form of stimulus package. There will be plenty of finger-pointing, but both parties seem to agree that voters prefer fiscal stimulus when times are tough.

Long Run is Still Positive

Investors and economists are split on how bad a 2023 recession might be, but more of them seem to be predicting a soft landing due to the Fed's interest rate hikes. This means a comparatively minor recession rather than a severe one. Even in the worst case scenario, where it takes a few years to pull out of a 2023 recession, the stock market will rise in the long run. If you're investing for a decade in the future, it's a good idea to keep investing rather than diverting extra income to your savings. Yes, share prices may fall for the next few years, but you'll own more shares that will rebound. It's better to buy the dip than try to buy back in only after stocks have been rising for a while.

The Fed has raised interest rates again, and the news is full of gloom and doom. However, this is precisely the situation that educated investors prepare for: not panicking and selling their investments to pocket the cash. With inflation still over 8 percent, taking money out of the stock market and putting it in savings accounts will only reduce your wealth. And there's evidence that the sky isn't falling: the currently-rising mortgage interest rates are still below the long-run average, and mortgage applications actually increased slightly last week. And while homebuilders are definitely feeling the pinch, home prices have yet to fall very much.

Check Long-Run Trends

Things seem bad, but they're not that bad. The U.S. suffered through high inflation during the late 1970s and early 1980s, but investors still made money. It wasn't great, but it did create real (adjusted for inflation) profit. While many stocks struggled, those representing commodities (goods) tended to do fine. With recessionary fears on the rise, it may be time to shift investments toward stocks that represent goods with relatively constant demand, such as agriculture, oil, and essential consumer items. But the Fed managed to get inflation under control by the early 1980s, so it has a roadmap - although it may be painful - to navigate the current crisis.

Government is Actively on the Case

The days of laissez-faire economics is definitely over. Although the Fed admits that its inflation-fighting interest rate hikes may indeed cause a recession, the federal government is ready to act. And, like it or not, even conservative Republicans have shown themselves willing to engage in some fiscal stimulus to court voters. If worse does come to worst and the United States ends up embroiled in a true recession, both parties will likely unite around some form of stimulus package. There will be plenty of finger-pointing, but both parties seem to agree that voters prefer fiscal stimulus when times are tough.

Long Run is Still Positive

Investors and economists are split on how bad a 2023 recession might be, but more of them seem to be predicting a soft landing due to the Fed's interest rate hikes. This means a comparatively minor recession rather than a severe one. Even in the worst case scenario, where it takes a few years to pull out of a 2023 recession, the stock market will rise in the long run. If you're investing for a decade in the future, it's a good idea to keep investing rather than diverting extra income to your savings. Yes, share prices may fall for the next few years, but you'll own more shares that will rebound. It's better to buy the dip than try to buy back in only after stocks have been rising for a while.