Expertise Provided by Mark Robertson

Industrial stocks with dividend are stocks of companies that distribute their significant portion of earning to their shareholders as dividend. These stocks are the major part of the investors' diversified portfolio. there are many companies who have a long history of paying dividend. These stocks are appealing to investors who want a steady income and long-term growth. However, it is essential to exercise caution and carefully evaluate the associated risks when selecting these stocks.

Characteristics of Industrial Stocks with Dividends

Following are some of the key characteristics of industrial stocks with dividends:

i. Consistent dividend payments: Companies that have a history of paying dividends are seen as stable and reliable investments. This is because they have proven their ability to make money, even during tough economic times.

ii. High dividend yields: Industrial stocks pay higher dividends than stocks in other sectors. These stocks have growth prospects, but they are often overlooked by sectors like technology or consumer goods.

iii. Defensive properties: Industrial stocks are often seen as an investment choice because they tend to hold their value even during times of market volatility. This is because they are not easily affected by changes, in the economy.

iv. Strong financial position: Industrial companies that are financially stable have a likelihood of paying dividends. This indicates that these companies have a track record, an amount of debt compared to their equity and a healthy cash flow.

v. Dividend growth potential: Investors who want to invest in stocks with dividends look for companies that can increase dividend payments. This shows the company can't keep dividends stable, but it can increase them for investors.

vi. Industry stability: Industrial companies primarily focus on manufacturing and producing goods that remain in demand regardless of conditions. This stability offers reassurance to investors who prioritize investing in dividend paying companies.

vii. Dividend payout ratio: The dividend payout ratio measures the percentage of a company’s earnings distributed as dividends to shareholders.

viii. Dividend safety: Considering the safety of dividends is also important, for investors looking into stocks that offer dividends. It involves assessing the company’s ability to sustain dividend payments during challenging circumstances. The evaluation looks at how stable the company is and its history of paying dividends.

ix. Diversification: Adding stocks with dividends to a diversified portfolio can be beneficial. To lower risk and protect your investments, spread them across different sectors, industries, and stock sizes. from potential losses.

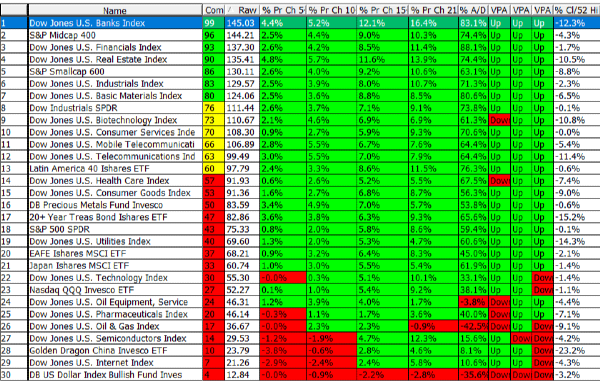

Source: Fidelity Investment

Source: Fidelity Investment

List of Industrial Stock with Dividend

Here are some top industrial stocks that pay dividends, along with their current yields;

- Union Pacific (UNP): 2.4%

- General Electric (GE): 1.8%

- United Parcel Service (UPS): 2.5%

- Lockheed Martin (LMT): 1.7%

- 3M (MMM): 2.9%

- Emerson Electric (EMR): 2.4%

- Illinois Tool Works (ITW): 2.1%

- Fastenal (FAST): 1.9%

- Apogee Enterprises (APOG): 2.1%

- Republic Services (RSG): 2.5%

Best industrial dividend stocks

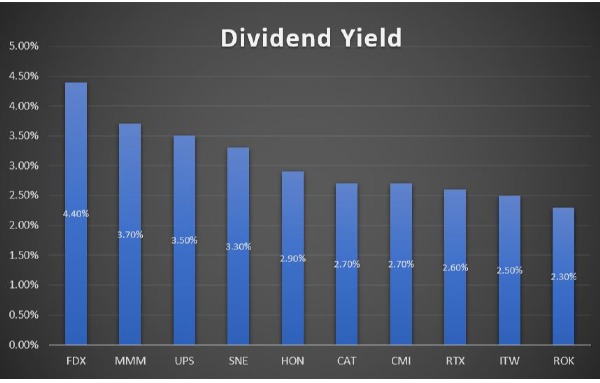

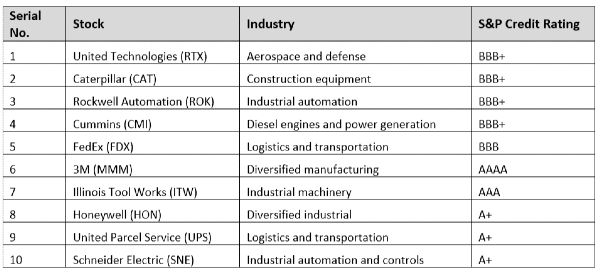

The best industrial dividend stocks are the ones that give a good dividend, increase their dividends, and have a strong financial position. Among the industrial dividend stocks are;

• High dividend industrial stocks: These stocks provide a dividend yield of 3% or more. Some famous examples are Union Pacific (UNP), General Electric (GE), and United Parcel Service (UPS).

These are some examples of industrial stocks with high dividend yields. There are companies in this sector that also offer appealing dividends. When considering stocks for your investment portfolio it is crucial to evaluate factors such as the financial stability of the company its competitive position and its growth prospects.

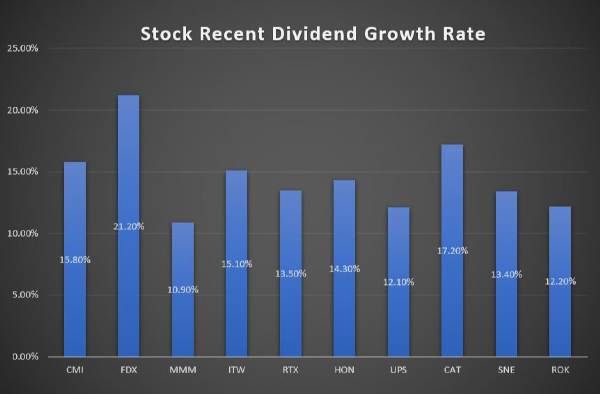

• Dividend growth industrial stocks: These stocks have demonstrated an ability to increase their dividends over time. Notable examples include 3M (MMM) Emerson Electric (EMR) and Illinois Tool Works (ITW).

• Industrial stocks with safe dividends: These companies can probably keep paying dividends, even in tough economic times. Some prominent examples include Fastenal (FAST) Apogee Enterprises (APOG) and Republic Services (RSG). Apart from these following are some other examples;

The above list is based on the following criteria:

- S&P Credit Rating of BBB+ or higher

- Dividend yield of 2.5% or higher

- Consistent dividend payments for at least 25 years

Choosing the Industrial Stock with Dividend

Selecting the industrial dividend stocks requires consideration of several factors that impact their stability, growth potential and overall investment value. Here is a comprehensive guide to help you choose the industrial dividend stocks, for your portfolio;

i. Evaluate Dividend Yield: Dividend yield represents the percentage of a stock current price that is paid out to shareholders as dividends. A higher dividend yield generally indicates a payout ratio suggesting that the company prioritizes returning profits to shareholders. However, it's essential to evaluate the company’s health to ensure that the dividend is sustainable.

ii. Analyze Dividend Growth Potential: The potential for dividend growth refers to how likely a company to increase its dividend payments over time. A consistent track record of increasing dividends serves as an indicator of a company’s strength and growth prospects. Look for companies that have demonstrated increases during economic downturns.

iii. Financial Stability: Financial stability plays a role in ensuring the sustainability of dividend payments. Evaluate metrics such as debt to equity ratio, cash flow and profitability. A strong balance sheet, with debt levels and healthy cash flow suggests that the company can continue paying dividends in challenging market conditions.

iv. Examine Competitive Landscape: The competitive landscape affects a company's profits and its ability to maintain dividends. Take a look, at industry dynamics, such as market share, competition and technological advancements. To stay successful, pick companies with a strong market position, loyal customers, and good products.

v. Industry and Sector Diversification: To reduce risks associated with industry sector downturns diversify your portfolio across different industries and sectors. Invest in dividend stocks from sectors within the realm to minimize exposure to the performance of any single sector.

vi. Stock Size Diversification: Spread your investments across stocks of sizes. Cap, mid cap and small cap stocks. This diversification helps manage risks while also offering rewards from companies, with varying market capitalizations.

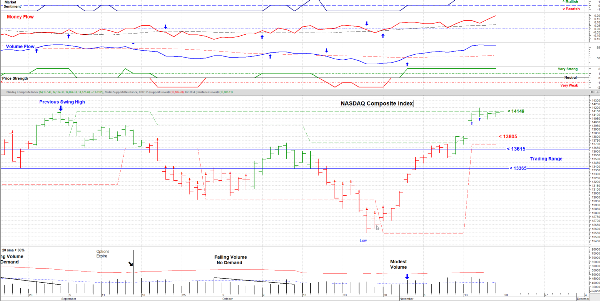

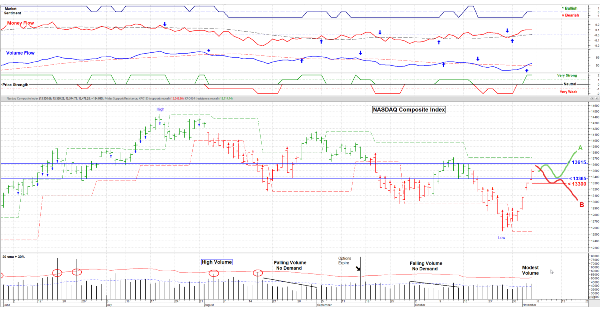

Source: Forbes Advisor

Source: Forbes Advisor

When to Buy Industrial Stocks with Dividend?

When it comes to investing in industrial dividend stocks timing is key to maximize returns and minimize risks. Here are some important factors to consider when deciding the moment to purchase industrial dividend stocks;

Market Downturns:

Industrial dividend stocks become more attractive when the market declines, as their dividend yields rise. Investors often seek income generating assets in times making industrial dividend stocks more appealing.

Sector Undervaluation:

If the entire industrial sector is undervalued it presents an opportunity to buy industrial dividend stocks at discounted prices. This situation may arise during periods of uncertainty or when investor sentiment, towards the sector is negative.

Individual Company Undervaluation:

When a specific industrial company is undervalued its dividend yield may surpass its average. This could be due, to factors impacting the company’s stock price while its underlying fundamentals remain strong.

Dividend Reinvestment Plan (DRIP) Availability:

If a company offers a (DRIP) it allows investors to automatically reinvest their dividends into shares of the company’s stock. This can be a long-term growth strategy as it compounds your returns over time.

Economic Conditions:

Take into account the situation before deciding to invest in dividend stocks from the industrial sector. When the economy is experiencing growth, industrial companies usually fare well which improves the chances of growing dividends.

Interest Rate Environment:

It's important to remember that when interest rates rise, stock prices may be affected. However, quality industrial dividend stocks with strong fundamentals may be less affected by changes in interest rates.

Sector-Specific Trends:

Keep an eye on industry trends that might have an impact, on the performance of industrial companies. To meet demand for industrial products and services, it's important to keep up with consumer preferences.

Company-Specific Developments:

Stay updated on any changes to a company, like its performance, management, and strategic plans. These factors can have both negative effects, on the company’s ability to pay dividends.

Advantages of Industrial Stocks with Dividends

Investing in industrial stocks with dividends can offer several advantages for investors. Here are some potential benefits:

1. Steady Income: Industrial stock with dividend is a regular stream of income for investors. This can be particularly for those investors who is looking for a reliable source of cash flow.

2. Dividend Growth: Some industrial companies increase their dividend payouts over time. Investors who hold such type of stock not only get income regularly bit their income increase as well with the increase in company’s profit.

3. Dividend Reinvestment: Dividend payments can be used to purchase additional number of shares. This can help to increase returns over the long term because of compounding effect.

4. Historical Stability: Since industrial sector is considered to be more stable compare to more cyclical or volatile sectors. This stability may help to increase the reliability of dividend payments.

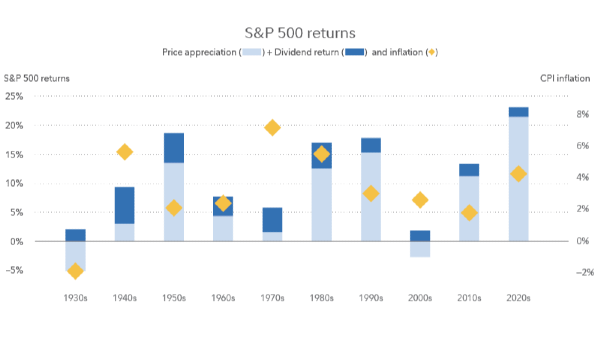

5. Inflation Hedge: The dividend payments help to reduce the effect of inflation on investors. Since, the dividend payment increases over time that’s why it helps investors to maintain their purchasing power.

6. Diversification: The dividend-paying industrial stocks help the investors to diversify their portfolio. Diversification helps spread risk and increase the exposure to different market sectors.

In a nutshell, investing in industrial dividend stocks is a long-term strategy. Before making investment decisions, it's important to research the company and understand the market conditions. Timing the investments strategically can increase the returns.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?

Expertise Provided by Mark Robertson

Industrial stocks with dividend are stocks of companies that distribute their significant portion of earning to their shareholders as dividend. These stocks are the major part of the investors' diversified portfolio. there are many companies who have a long history of paying dividend. These stocks are appealing to investors who want a steady income and long-term growth. However, it is essential to exercise caution and carefully evaluate the associated risks when selecting these stocks.

Characteristics of Industrial Stocks with Dividends

Following are some of the key characteristics of industrial stocks with dividends:

i. Consistent dividend payments: Companies that have a history of paying dividends are seen as stable and reliable investments. This is because they have proven their ability to make money, even during tough economic times.

ii. High dividend yields: Industrial stocks pay higher dividends than stocks in other sectors. These stocks have growth prospects, but they are often overlooked by sectors like technology or consumer goods.

iii. Defensive properties: Industrial stocks are often seen as an investment choice because they tend to hold their value even during times of market volatility. This is because they are not easily affected by changes, in the economy.

iv. Strong financial position: Industrial companies that are financially stable have a likelihood of paying dividends. This indicates that these companies have a track record, an amount of debt compared to their equity and a healthy cash flow.

v. Dividend growth potential: Investors who want to invest in stocks with dividends look for companies that can increase dividend payments. This shows the company can't keep dividends stable, but it can increase them for investors.

vi. Industry stability: Industrial companies primarily focus on manufacturing and producing goods that remain in demand regardless of conditions. This stability offers reassurance to investors who prioritize investing in dividend paying companies.

vii. Dividend payout ratio: The dividend payout ratio measures the percentage of a company’s earnings distributed as dividends to shareholders.

viii. Dividend safety: Considering the safety of dividends is also important, for investors looking into stocks that offer dividends. It involves assessing the company’s ability to sustain dividend payments during challenging circumstances. The evaluation looks at how stable the company is and its history of paying dividends.

ix. Diversification: Adding stocks with dividends to a diversified portfolio can be beneficial. To lower risk and protect your investments, spread them across different sectors, industries, and stock sizes. from potential losses.

List of Industrial Stock with Dividend

Here are some top industrial stocks that pay dividends, along with their current yields;

Best industrial dividend stocks

The best industrial dividend stocks are the ones that give a good dividend, increase their dividends, and have a strong financial position. Among the industrial dividend stocks are;

• High dividend industrial stocks: These stocks provide a dividend yield of 3% or more. Some famous examples are Union Pacific (UNP), General Electric (GE), and United Parcel Service (UPS).

These are some examples of industrial stocks with high dividend yields. There are companies in this sector that also offer appealing dividends. When considering stocks for your investment portfolio it is crucial to evaluate factors such as the financial stability of the company its competitive position and its growth prospects.

• Dividend growth industrial stocks: These stocks have demonstrated an ability to increase their dividends over time. Notable examples include 3M (MMM) Emerson Electric (EMR) and Illinois Tool Works (ITW).

• Industrial stocks with safe dividends: These companies can probably keep paying dividends, even in tough economic times. Some prominent examples include Fastenal (FAST) Apogee Enterprises (APOG) and Republic Services (RSG). Apart from these following are some other examples;

The above list is based on the following criteria:

Choosing the Industrial Stock with Dividend

Selecting the industrial dividend stocks requires consideration of several factors that impact their stability, growth potential and overall investment value. Here is a comprehensive guide to help you choose the industrial dividend stocks, for your portfolio;

i. Evaluate Dividend Yield: Dividend yield represents the percentage of a stock current price that is paid out to shareholders as dividends. A higher dividend yield generally indicates a payout ratio suggesting that the company prioritizes returning profits to shareholders. However, it's essential to evaluate the company’s health to ensure that the dividend is sustainable.

ii. Analyze Dividend Growth Potential: The potential for dividend growth refers to how likely a company to increase its dividend payments over time. A consistent track record of increasing dividends serves as an indicator of a company’s strength and growth prospects. Look for companies that have demonstrated increases during economic downturns.

iii. Financial Stability: Financial stability plays a role in ensuring the sustainability of dividend payments. Evaluate metrics such as debt to equity ratio, cash flow and profitability. A strong balance sheet, with debt levels and healthy cash flow suggests that the company can continue paying dividends in challenging market conditions.

iv. Examine Competitive Landscape: The competitive landscape affects a company's profits and its ability to maintain dividends. Take a look, at industry dynamics, such as market share, competition and technological advancements. To stay successful, pick companies with a strong market position, loyal customers, and good products.

v. Industry and Sector Diversification: To reduce risks associated with industry sector downturns diversify your portfolio across different industries and sectors. Invest in dividend stocks from sectors within the realm to minimize exposure to the performance of any single sector.

vi. Stock Size Diversification: Spread your investments across stocks of sizes. Cap, mid cap and small cap stocks. This diversification helps manage risks while also offering rewards from companies, with varying market capitalizations.

When to Buy Industrial Stocks with Dividend?

When it comes to investing in industrial dividend stocks timing is key to maximize returns and minimize risks. Here are some important factors to consider when deciding the moment to purchase industrial dividend stocks;

Market Downturns: Industrial dividend stocks become more attractive when the market declines, as their dividend yields rise. Investors often seek income generating assets in times making industrial dividend stocks more appealing.

Sector Undervaluation: If the entire industrial sector is undervalued it presents an opportunity to buy industrial dividend stocks at discounted prices. This situation may arise during periods of uncertainty or when investor sentiment, towards the sector is negative.

Individual Company Undervaluation: When a specific industrial company is undervalued its dividend yield may surpass its average. This could be due, to factors impacting the company’s stock price while its underlying fundamentals remain strong.

Dividend Reinvestment Plan (DRIP) Availability: If a company offers a (DRIP) it allows investors to automatically reinvest their dividends into shares of the company’s stock. This can be a long-term growth strategy as it compounds your returns over time.

Economic Conditions: Take into account the situation before deciding to invest in dividend stocks from the industrial sector. When the economy is experiencing growth, industrial companies usually fare well which improves the chances of growing dividends.

Interest Rate Environment: It's important to remember that when interest rates rise, stock prices may be affected. However, quality industrial dividend stocks with strong fundamentals may be less affected by changes in interest rates.

Sector-Specific Trends: Keep an eye on industry trends that might have an impact, on the performance of industrial companies. To meet demand for industrial products and services, it's important to keep up with consumer preferences.

Company-Specific Developments: Stay updated on any changes to a company, like its performance, management, and strategic plans. These factors can have both negative effects, on the company’s ability to pay dividends.

Advantages of Industrial Stocks with Dividends

Investing in industrial stocks with dividends can offer several advantages for investors. Here are some potential benefits:

1. Steady Income: Industrial stock with dividend is a regular stream of income for investors. This can be particularly for those investors who is looking for a reliable source of cash flow.

2. Dividend Growth: Some industrial companies increase their dividend payouts over time. Investors who hold such type of stock not only get income regularly bit their income increase as well with the increase in company’s profit.

3. Dividend Reinvestment: Dividend payments can be used to purchase additional number of shares. This can help to increase returns over the long term because of compounding effect.

4. Historical Stability: Since industrial sector is considered to be more stable compare to more cyclical or volatile sectors. This stability may help to increase the reliability of dividend payments.

5. Inflation Hedge: The dividend payments help to reduce the effect of inflation on investors. Since, the dividend payment increases over time that’s why it helps investors to maintain their purchasing power.

6. Diversification: The dividend-paying industrial stocks help the investors to diversify their portfolio. Diversification helps spread risk and increase the exposure to different market sectors.

In a nutshell, investing in industrial dividend stocks is a long-term strategy. Before making investment decisions, it's important to research the company and understand the market conditions. Timing the investments strategically can increase the returns.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?