Popular apparel manufacturing stocks include Gildan Activewear (GIL), Levi Strauss (LEVI), VF Corporation (VFC), and Kontoor Brands (KTB), all showing strong investor interest. These picks are ranked daily by top investors on StockBossUp.

Apparel manufacturing stocks represent companies that produce clothing and textiles. These businesses supply retailers, brands, and private labels. They focus on efficiency, quality, and global sourcing.

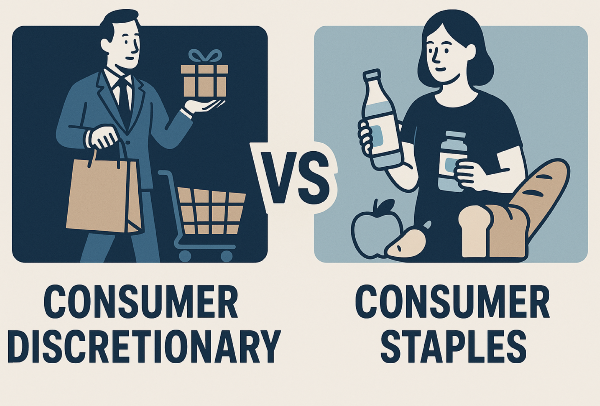

This industry belongs to the consumer discretionary sector. That means performance often rises and falls with consumer confidence. When people spend more on fashion, manufacturers benefit. When demand slows, margins may shrink.

StockBossUp ranks apparel manufacturing stocks using a community-driven system. The rankings come from top investors who consistently outperform. These rankings update daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Apparel Manufacturing Stocks Unique

These companies focus on production, not direct retail. They manage factories, source materials, and fulfill orders for brands and stores. Some are vertically integrated, controlling design and distribution.

Manufacturers face global challenges. Labor costs, trade rules, and currency shifts affect margins. Sustainability and compliance are growing concerns. Companies that adapt quickly often gain market share.

Technology helps improve efficiency. Automation, digital design, and demand forecasting reduce waste. Brands that invest in innovation often perform better.

Industry Breakdown Table

| Category |

Focus Area |

Investor Notes |

| Contract Manufacturers |

Bulk production, global sourcing |

Scale and cost efficiency |

| Vertically Integrated |

Design to delivery |

Brand control, margin strength |

| Private Label Suppliers |

Retail partnerships |

Volume-driven, low visibility |

| Technical Fabric Makers |

Performance textiles |

Innovation and niche demand |

Top Apparel Manufacturing Stocks to Watch

Below are examples of well-known companies in this space. These are not recommendations. They show the types of businesses investors often follow.

1. Gildan Activewear Inc.

Gildan (GIL)

Gildan produces blank apparel for printing and private labels. It focuses on scale and cost control. Investors watch its margins and sustainability efforts.

2. Levi Strauss & Co.

Levi Strauss (LEVI)

Levi’s is a global denim brand. It owns factories and controls design. The company benefits from brand strength and direct-to-consumer growth.

3. VF Corporation

VF Corp (VFC)

VF owns brands like The North Face and Vans. It manages design, production, and retail. Investors track its global footprint and product mix.

4. Kontoor Brands Inc.

Kontoor (KTB)

Kontoor owns Wrangler and Lee. It focuses on denim and casual wear. The company benefits from strong retail partnerships and brand loyalty.

5. PVH Corp.

PVH (PVH)

PVH owns Calvin Klein and Tommy Hilfiger. It combines design, manufacturing, and global distribution. Investors watch its licensing and brand strategy.

Trends Driving Performance

Nearshoring is growing. Companies are moving production closer to customers. This reduces delays and improves flexibility.

Automation is expanding. Machines handle cutting, sewing, and packaging. This lowers labor costs and boosts output.

Sustainability matters. Consumers want ethical sourcing and eco-friendly materials. Manufacturers that meet these goals build trust.

Performance fabrics are rising. Moisture-wicking, stretch, and recycled textiles are in demand. Brands that innovate often gain market share.

Key Metrics Table

| Metric |

Why It Matters |

Impact on Investors |

| Production Capacity |

Shows ability to scale |

Higher capacity supports growth |

| Operating Margin |

Measures cost control |

Strong margins attract capital |

| Client Mix |

Reveals revenue stability |

Diverse clients reduce risk |

| Sustainability Score |

Reflects ESG performance |

High scores build brand trust |

Evaluating Apparel Manufacturing Stocks Like a Pro

Start with revenue and margin trends. These show whether a company is growing and managing costs. Look at production capacity to understand scale.

Check client mix. Companies that serve many brands are more stable. Those with one or two clients may face more risk.

Innovation matters. Technical fabrics and automation help improve margins. Companies that invest in R&D often outperform.

Balance sheets reveal financial health. Strong cash flow and low debt support expansion. Weak finances may limit growth.

Why These Stocks Fit in a Consumer Discretionary Portfolio

Apparel manufacturing stocks rise and fall with fashion demand. When consumers spend more, brands order more. When demand slows, production may drop.

These stocks offer exposure to global trends, efficiency, and innovation. They complement retail and brand holdings in a portfolio.

Some companies also offer defensive traits. Basics like socks and underwear see steady demand. That helps balance risk.

Using StockBossUp to Find the Best Picks

StockBossUp ranks apparel manufacturing stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Apparel manufacturing stocks offer exposure to global production, efficiency, and fashion cycles. They benefit from automation, sustainability, and brand partnerships. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this evolving industry.

Popular apparel manufacturing stocks include Gildan Activewear (GIL), Levi Strauss (LEVI), VF Corporation (VFC), and Kontoor Brands (KTB), all showing strong investor interest. These picks are ranked daily by top investors on StockBossUp.

Apparel manufacturing stocks represent companies that produce clothing and textiles. These businesses supply retailers, brands, and private labels. They focus on efficiency, quality, and global sourcing.

This industry belongs to the consumer discretionary sector. That means performance often rises and falls with consumer confidence. When people spend more on fashion, manufacturers benefit. When demand slows, margins may shrink.

StockBossUp ranks apparel manufacturing stocks using a community-driven system. The rankings come from top investors who consistently outperform. These rankings update daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Apparel Manufacturing Stocks Unique

These companies focus on production, not direct retail. They manage factories, source materials, and fulfill orders for brands and stores. Some are vertically integrated, controlling design and distribution.

Manufacturers face global challenges. Labor costs, trade rules, and currency shifts affect margins. Sustainability and compliance are growing concerns. Companies that adapt quickly often gain market share.

Technology helps improve efficiency. Automation, digital design, and demand forecasting reduce waste. Brands that invest in innovation often perform better.

Industry Breakdown Table

Top Apparel Manufacturing Stocks to Watch

Below are examples of well-known companies in this space. These are not recommendations. They show the types of businesses investors often follow.

1. Gildan Activewear Inc.

Gildan (GIL)

Gildan produces blank apparel for printing and private labels. It focuses on scale and cost control. Investors watch its margins and sustainability efforts.

2. Levi Strauss & Co.

Levi Strauss (LEVI)

Levi’s is a global denim brand. It owns factories and controls design. The company benefits from brand strength and direct-to-consumer growth.

3. VF Corporation

VF Corp (VFC)

VF owns brands like The North Face and Vans. It manages design, production, and retail. Investors track its global footprint and product mix.

4. Kontoor Brands Inc.

Kontoor (KTB)

Kontoor owns Wrangler and Lee. It focuses on denim and casual wear. The company benefits from strong retail partnerships and brand loyalty.

5. PVH Corp.

PVH (PVH)

PVH owns Calvin Klein and Tommy Hilfiger. It combines design, manufacturing, and global distribution. Investors watch its licensing and brand strategy.

Trends Driving Performance

Nearshoring is growing. Companies are moving production closer to customers. This reduces delays and improves flexibility.

Automation is expanding. Machines handle cutting, sewing, and packaging. This lowers labor costs and boosts output.

Sustainability matters. Consumers want ethical sourcing and eco-friendly materials. Manufacturers that meet these goals build trust.

Performance fabrics are rising. Moisture-wicking, stretch, and recycled textiles are in demand. Brands that innovate often gain market share.

Key Metrics Table

Evaluating Apparel Manufacturing Stocks Like a Pro

Start with revenue and margin trends. These show whether a company is growing and managing costs. Look at production capacity to understand scale.

Check client mix. Companies that serve many brands are more stable. Those with one or two clients may face more risk.

Innovation matters. Technical fabrics and automation help improve margins. Companies that invest in R&D often outperform.

Balance sheets reveal financial health. Strong cash flow and low debt support expansion. Weak finances may limit growth.

Why These Stocks Fit in a Consumer Discretionary Portfolio

Apparel manufacturing stocks rise and fall with fashion demand. When consumers spend more, brands order more. When demand slows, production may drop.

These stocks offer exposure to global trends, efficiency, and innovation. They complement retail and brand holdings in a portfolio.

Some companies also offer defensive traits. Basics like socks and underwear see steady demand. That helps balance risk.

Using StockBossUp to Find the Best Picks

StockBossUp ranks apparel manufacturing stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Apparel manufacturing stocks offer exposure to global production, efficiency, and fashion cycles. They benefit from automation, sustainability, and brand partnerships. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this evolving industry.