Introduction

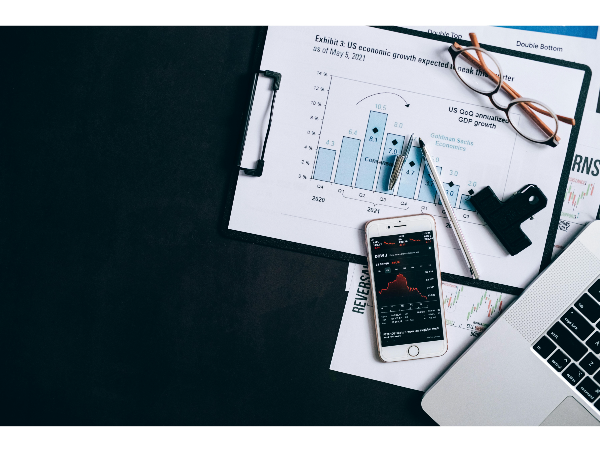

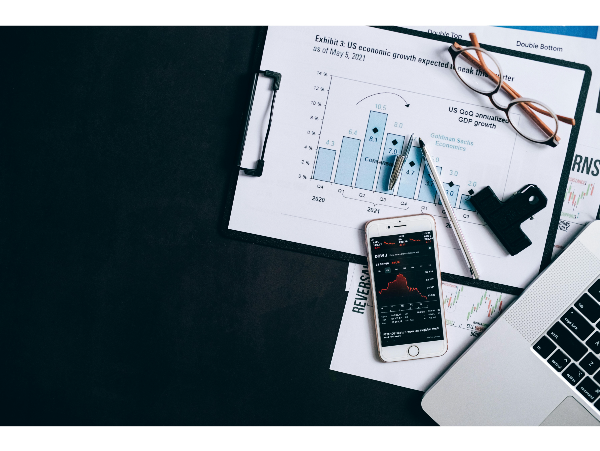

For decades, the S&P 500 has served as the benchmark for U.S. stock market performance. Its blue-chip constituents—giant companies with global reach—are synonymous with stability, resilience, and long-term growth. Yet, beneath the surface, a less-heralded group of small-cap stocks has, at times, delivered returns that far outpace the S&P 500. These companies, typically valued between $300 million and $2 billion, offer investors a unique blend of risk and reward. In recent years, and especially in 2024 and 2025, small-cap stocks have begun to shine anew, capturing the attention of savvy investors eager for outsized gains.

This essay explores the drivers behind small-cap outperformance, presents recent examples, and examines why the current environment may be especially favorable for these nimble market players.

________________________________________

The Cyclical Nature of Small-Cap vs. Large-Cap Performance

Stock market leadership is cyclical. For much of the past decade, large-cap stocks—especially the “Magnificent Seven” tech giants—have dominated returns, overshadowing small- and mid-cap peers2. However, history shows that these cycles eventually reverse. According to Furey Research Partners, leadership alternates between large- and small-caps in cycles typically lasting seven to ten years2. The current era of large-cap outperformance has been unusually long, but signs suggest a shift is underway as we move through 2025.

Small-cap stocks, typically valued between $300 million and $2 billion in market capitalization, are often overlooked by the average investor. However, billionaire investors see them as opportunities for significant growth. These companies can offer outsized returns, but they also carry higher volatility and risk. Here’s a curated list of small-cap stocks that billionaires are buying, based on recent market trends and investor filings.