Introduction

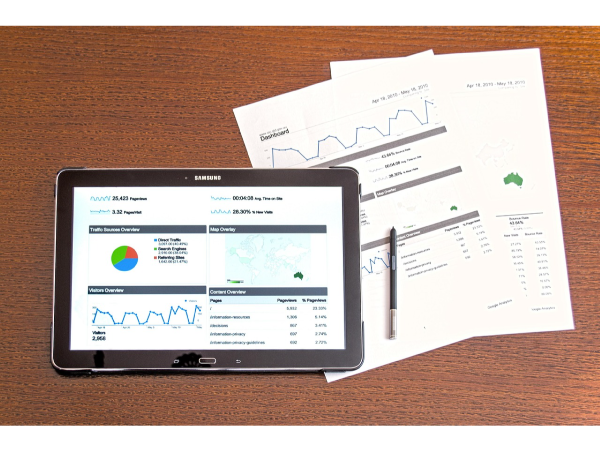

For decades, the S&P 500 has served as the benchmark for U.S. stock market performance. Its blue-chip constituents—giant companies with global reach—are synonymous with stability, resilience, and long-term growth. Yet, beneath the surface, a less-heralded group of small-cap stocks has, at times, delivered returns that far outpace the S&P 500. These companies, typically valued between $300 million and $2 billion, offer investors a unique blend of risk and reward. In recent years, and especially in 2024 and 2025, small-cap stocks have begun to shine anew, capturing the attention of savvy investors eager for outsized gains.

This essay explores the drivers behind small-cap outperformance, presents recent examples, and examines why the current environment may be especially favorable for these nimble market players.

________________________________________

The Cyclical Nature of Small-Cap vs. Large-Cap Performance

Stock market leadership is cyclical. For much of the past decade, large-cap stocks—especially the “Magnificent Seven” tech giants—have dominated returns, overshadowing small- and mid-cap peers2. However, history shows that these cycles eventually reverse. According to Furey Research Partners, leadership alternates between large- and small-caps in cycles typically lasting seven to ten years2. The current era of large-cap outperformance has been unusually long, but signs suggest a shift is underway as we move through 2025.

Introduction: Building a Downturn Fortress Small-cap stocks ($300M–$2B market cap) under $10 are your portfolio’s secret weapons, standing tall when markets crumble. In Q1 2025, the Russell 2000 rose 10%, trailing the S&P 500’s 15% YTD return (Yahoo Finance), but resilient small-caps held firm during a 7% Nifty Smallcap 250 dip (Livemint). With low debt-to-equity (<0.5), positive cash flow, and defensive sectors like healthcare and consumer staples, these stocks are built to last (AllianceBernstein). X users hype them as “recession-proof gems” (@StockSavant). This treasure hunter’s guide uncovers 10 small-cap stocks designed for 2025’s volatility, backed by fresh data, X sentiment, and beginner-friendly strategies. Grab your armor—let’s fortify your wealth! Why Resilient Small-Caps Shine in Downturns Small-caps under $10 thrive in corrections because: Defensive Sectors: Healthcare and staples see steady demand (Forbes). Low Debt: Debt-to-equity <0.5 minimizes insolvency risk (J.P. Morgan). Cash Flow: Positive cash flow sustains operations without loans (Investopedia). In Q2 2025, high-ROE small-caps dropped 5% vs. 9% for broader small-caps during a tariff-led dip (AllianceBernstein). Here are 10 resilient picks for 2025. The 10 Resilient Small-Cap Gems

Closing Thoughts: Fortify Your Wealth Small-caps like SENEA, HBIO, and AVA are downturn-proof rockets, with low debt, strong cash flow, and defensive sector strength. Start with $500 on Fidelity, screen on Finviz, and verify on SEC.gov. This isn’t just investing—it’s building a fortress against market storms. Track X buzz, pick your strongholds, and secure your portfolio!